Apadmi & Financial Services

Secure, compliant technology that optimises user experience

Apadmi delivers outstanding mobile app solutions for the financial services industry that truly shake up the sector. We focus on bringing customer journeys to life by delighting end-users with smooth onboarding processes and innovative, accessible, UX design.

With positive user experiences comes increased brand trust and loyalty. Our products aim to unlock value by solving business problems always with security and compliance in mind.

Our clients in the financial services industry

How financial services organisations find value with Apadmi

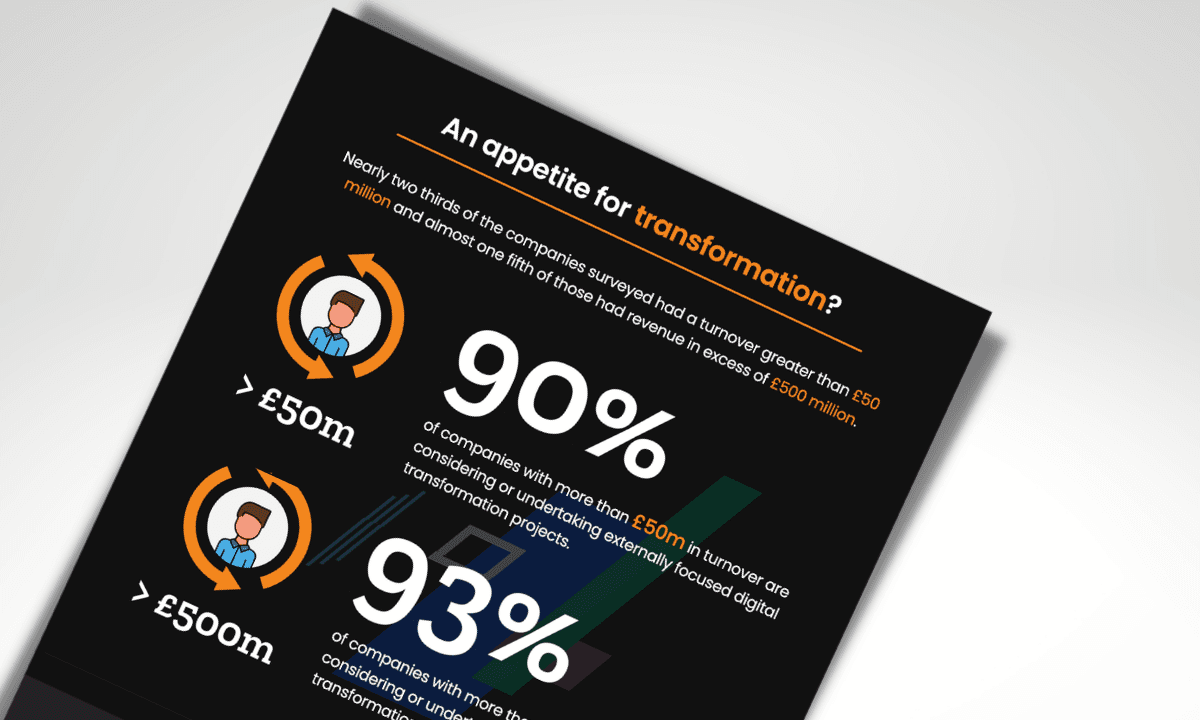

Digital transformation

Financial services businesses work with Apadmi to refresh and replace their legacy systems to provide customers with an improved digital experience. Some traditional banks and wealth management businesses still have a way to go when it comes to digital transformation. Improving digital experiences can drive customer engagement, greater retention and allows your brand to stay competitive in the market.

Seamless onboarding experiences

An element of friction is necessary when onboarding new customers in financial services. However, this doesn’t have to mean difficult or clunky UX. We craft award-winning onboarding experiences that take your customers through each necessary step with clear instructions and intuitive UX design, ensuring the experience is smooth, secure and as swift as possible.

Enhanced safety, security and trust

Customer trust is essential and to build it, you need to provide secure mobile experiences to reassure users their sensitive information is in safe hands. From biometric ID to automatic log outs, our mobile experts create FS solutions which are secure, seamless and compliant with regulatory guidelines.

Data and analytics

Knowing your customers - specifically their behaviours and needs, can help you make key improvements to your mobile product. From custom data dashboards to analysing user journeys, our data and analytics team provide rich data sources which enable more informed decisions on your digital product roadmap.

New and improved payment channels

Providing a new payment channel, or improving an existing one, can allow customers greater ease and flexibility when making and managing payments. It can also help to increase transactional value while reducing incoming calls to contact centres and decreasing fraudulent activity - as our clients Argos Financial Services found.

Keep digital products performing

With customers wanting to make smooth, secure financial transactions at the touch of a button, keeping your product continuously performing at its peak is crucial. We understand downtime and bugs can greatly cost financial services businesses time, trust and revenue - which is why Apadmi’s Performance team provides 24/7 support and regular maintenance to help avoid costly issues.

Areas of financial services we specialise in

Banking

From commercial to central banking; our mobile experts are able to design, build and optimise mobile digital products for a range of banking organisations. We are trusted by traditional banks such as Barclays, and challenger banks such as Chetwood, to create and optimise products adapted to the needs of both their customers and their business.

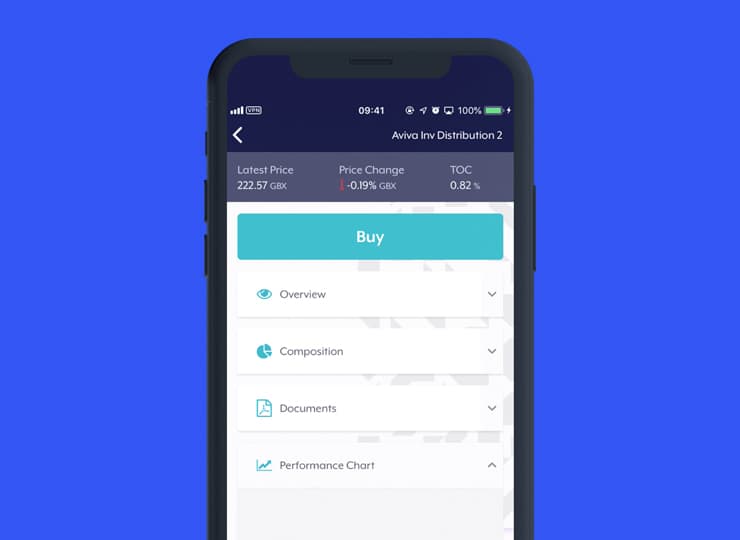

Investment and wealth management

Working with historical wealth management giants such as Charles Stanley has given our teams rich experience in creating mobile experiences which enable smooth trading, investments and transactions. We helped them understand the importance of excellent user interfaces that make wealth management simple and manageable for your customers.

Insurance

From helping Aviva to create its very first iOS app, to crafting new web experiences for DayInsure, Apadmi’s mobile experts have helped address some key customer challenges with the digital products it’s built for its insurance clients. Mobile is an efficient channel for insurers to allow for easy account management, up-sell, cross-sell and to drive customer retention.

Our expertise

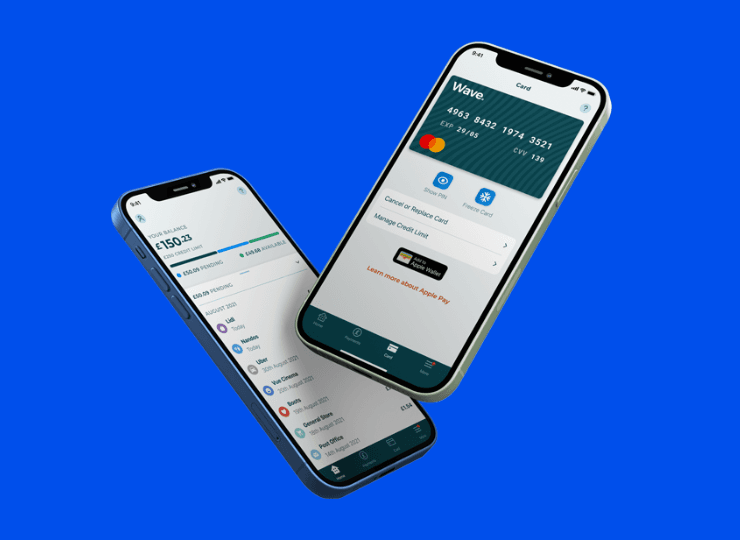

Chetwood Financial

An inclusive credit card that users love

Chetwood needed to create an easy-to-use, secure digital product which supported customers in need of a safe and reliable way to access their finances.

Chetwood could not compromise on quality user experience. They trusted Apadmi's expertise across discovery, design, strategy and mobile app development to create an all-new product - the Wave app.

We surpassed expectations with the following results:

More than 2.5 million transactions at over 150,000 merchants since launch

A swift onboarding process which 99% of customers rated as ‘easy’ or ‘very easy’

98% of customers are ‘very satisfied’ or ‘satisfied’ with Wave

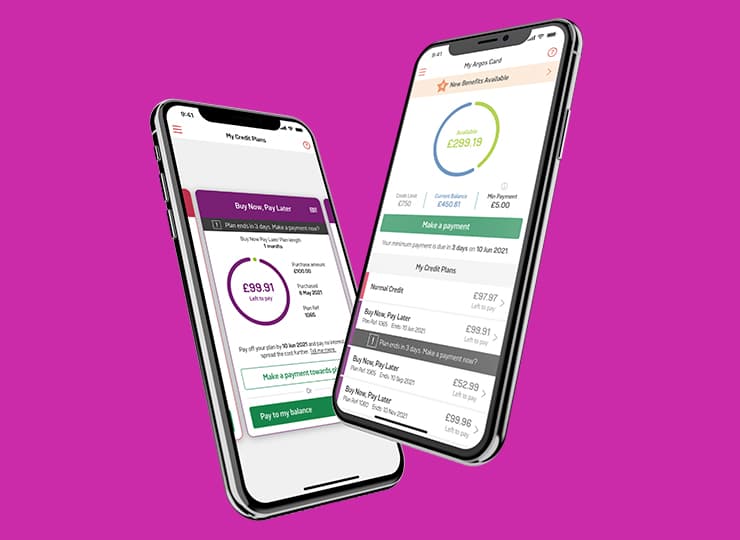

Argos Financial

Making credit easier to manage

Argos needed a better way to help store card customers manage their accounts - they came to Apadmi to create the My Argos Card App. Its aim was to facilitate self-service and to allow customers to manage payments with confidence.

Apadmi rose to the challenge of integrating new technology with existing legacy systems in a highly regulated environment, without compromising on user experience.

The collaboration produced some successful results:

66% increase in transactional value in the first six months after launch

The app became the biggest payment channel for Argos within 6 months

A major decrease in phone calls to customer service, meaning huge cost savings

Charles Stanley

Helping users manage share trading and secure payments

Charles Stanley is one of the UK’s largest wealth management companies. Apadmi was approached to improve Charles Stanley’s existing apps, and add new features to make the experience more engaging for clients.

The collaboration leaned on Apadmi’s expertise in complex system integrations, UX/UI design, product strategy, and app rebuilds to deliver this.

The app now enables users to:

Trade shares smoothly via the app

Easily navigate the app with a full UX and design refresh that included accessibility friendly design

Have peace of mind with increased security thanks to a memorable word offered alongside PIN

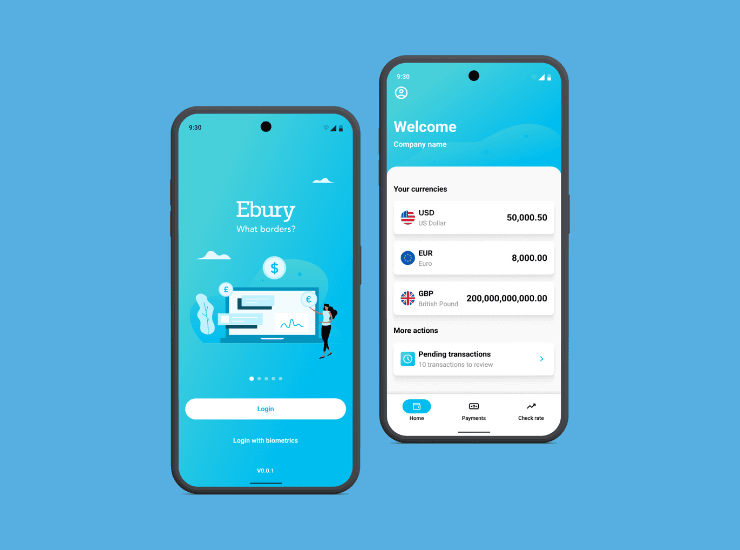

Ebury

Mobilising global transactions for growing fintech

Delivering annual transactions of over £27 billion, Ebury provides international payments and collections, FX in more than 130 currencies, FX risk management and business lending.

Ebury selected Apadmi to scale their ambitions and take advantage of mobile as a key channel for customer engagement and retention. Apadmi’s product, strategy, design and development teams delivered a mobile app that:

Gives customers the ability to trade in 130+ currencies

Provides high-level of security to give customers peace of mind for large transactions

Has a 5* app store rating, with excellent user feedback

Insights & Resources

View our insights

The latest from our world and things we've found interesting in everybody else's.