What can we do with data in financial services?

by Sam Shaw-Finance Journalist|Thu Mar 03 2022

Ahead of Apadmi’s webinar to discuss data and digital in financial services, host and financial journalist Sam Shaw examines some of the subjects we’ll be covering which could be keeping customer experience owners awake at night.

None of us need to read another statistic on how the pandemic has seen digital adoption in financial services race up the priority list. But it’s a hot topic for a reason.

The sector – whether advised or self-served, wealth or asset management, banking or insurance – is acutely aware that the relationship between financial providers and end consumers must tick a number of boxes. And in order to do so, digital transformation is essential.

Boring, neglected and compliant

Imagine the intersection: financial conversations are vital (yet can be boring); personal (yet must be compliant); and hugely neglected in terms of the opportunity on offer.

That’s where things have historically sat.

But it doesn’t have to be that way. The financial services sector has the potential to access a rich bank of data (with the right permissions of course) which could solve many operational inefficiencies, reduce costs, offer consumers an improved experience and hopefully better financial outcomes.

It was happening slowly anyway, but Covid forced a collective realisation that sitting in front of someone over coffee to have a ‘utility’ conversation was nice but not essential. Digital customer experiences came into sharper focus, as did our understanding of loyalty across financial brands.

Dealing with financial affairs tends to get shoved down the ‘to-do’ list, so can data help with a prompt from time to time?

Data is disrupting and being disrupted

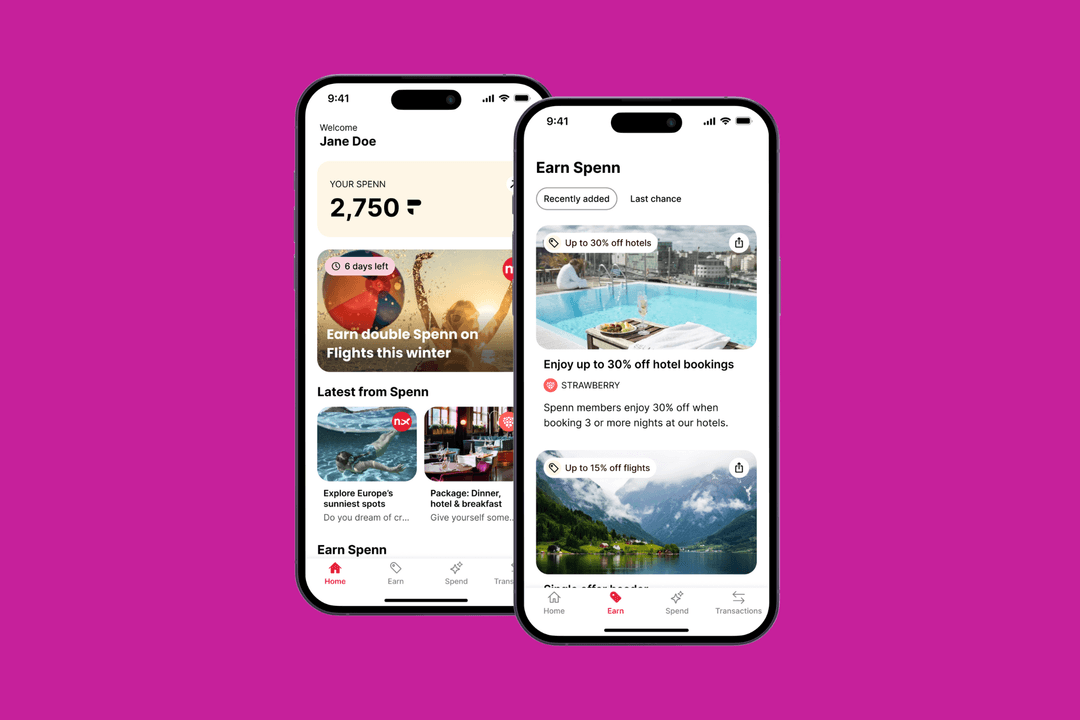

Mobile solutions and digital partnerships now sit front and centre – underpinned by data.

This is perfectly illustrated by Fintech players coming to market and challenging legacy names; a wider acknowledgement that people will be brand agnostic but service-led; and that users may increasingly use multiple providers even in the same space.

People want a personal service, but not necessarily in person. We’re all busy and increasingly impatient with the corporate world, expecting an Amazon, Google or [insert other big tech name here] level of service in all aspects of life.

Even if certain data gets captured, stored and interrogated effectively, how can it then be put to good use?

What’s in it for the client, when ‘client’ could mean an individual investor of the future, a long-term advised relationship spanning multiple generations, a company running an employee benefits programme or a pension fund responsible for tens of thousands of retirement pots?

New and old - an approach for all

Approaches to client segmentation are finally being reinvigorated and the constant challenge faced is how to retain and continue to engage with existing clients of one demographic while appealing to a new generation with an entirely different mindset.

Trillions of pounds (in one form or another) are set to move from a generation of baby boomers into the hands of their children and grandchildren. Data can help improve the methods, modes and timings of conversations to be had with each of them.

Personas are ever-more important, finetuned using data with increasing precision. What lessons can be learned from other, more consumer-first, sectors without the regulatory burdens?

Younger users may crave mobile-first experiences, yet their lack of friction and security (both physical and cyber) raises concerns. Where is omnichannel working at its best for the wealth and investment sectors to learn from and how can we optimise who sees what and when?

There are lots of questions. Our discussion on March 16th will hopefully provide some answers, and there will undoubtedly be plenty of ideas to take away.

Watch the webinar on-demand now

Watch our financial services webinar with leaders from Aviva Investors, Wealth Wizards, M&G and Charles Stanley, chaired by finance journalist Sam Shaw on-demand now.

Share