Is the unbundling of financial services good or bad?

Are digital products blowing everything further apart, or helping put things back together?

The unbundling, and subsequent re-bundling, of financial services is not a new concept. The surge of fintech businesses and subsequent impact of streamlined customer journeys upon existing banks is well documented.

But within the cycle of offering customers greater choice through many smaller products instead of the legacy approach of a one-stop-shop from more established banking brands, where do we currently find ourselves?

Since the iPhone launched 15 years ago and put banking firmly in your pocket, things have come a long way. Fintechs may have stolen a march on the old guard, but the big banks have done some catching up.

“Fintechs do have a competitive advantage in being able to move quickly,” Emma Kerr, Strategic partnerships, VISA told the Fintech Insider podcast. “That said JP Morgan is the fastest growing banking app in Europe today. Banks have woken up to the fact that they need good UX to compete.”

So the playing field has evened out, but are digital banking services still unbundling, or is the desire to have everything in one place, in fact making convergence the order of the day? And what role are digital products playing in that?

Apple and Google unbundle

First it might be helpful to briefly look at the driving forces behind the cyclical phases of bundling and unbundling in financial services. And, like many industries, it starts with the tech giants.

The App Store and Google Play have created an abundance of choice when it comes to creating and finding financial services tools.

That’s great for the customer, who can find whichever works best for them. It’s also great for creators of brilliant digital products (essentially FinTechs), who by delivering a great customer experience around a specific service (FX, payments, credit) are able to take ownership of a slither of the market.

Gone are the days when your current account, savings, mortgage and holiday money all pass through the same bank. We’re able to pick and choose to find the best fit and therefore services have become component based and unbundled.

Re-bundle once more, but with CX at the core

Having carved out a corner of the market, the next logical step for businesses is to drive growth by either expanding the reach of its core service, or consolidating with others.

So in the race for market share, services are being re-bundled to create complimentary revenue opportunities.

However, the essential ingredient to this amalgamation of functionality is being able to maintain excellent customer experience. The foundation of making boring and mundane financial tasks frictionless and pain-free is what has shaken up the market in the first place, so must be fiercely guarded.

“You can’t take the approach of - we’re going to build it and as long as it’s more awesome than the awful experience you had historically, then things are just magically going to go right,” says Vasily Starostenko, Head of Product at Revolut.

“Well, that’s a mandatory and important factor, but unfortunately it’s not enough. To make it closer to what will be enough, you have to listen to what the customer is saying.”

Winning digital hearts and minds

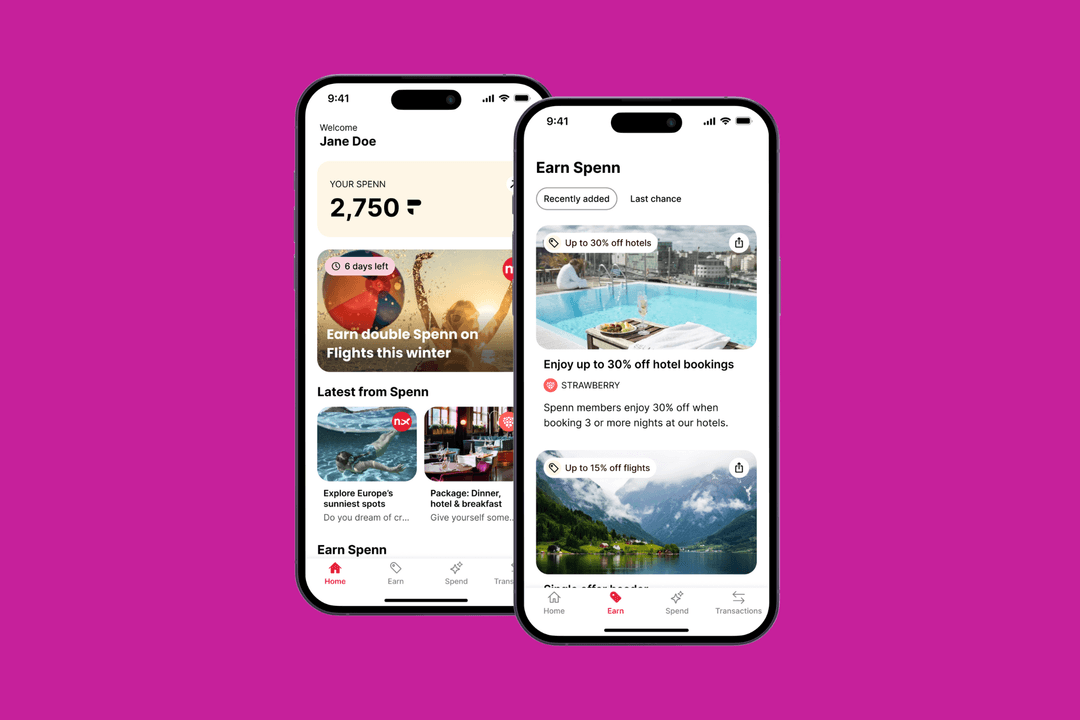

The battleground where that absolute focus on customer experience is increasingly taking place is in people’s palms. The mobile experience delivered by any financial service is where customer hearts and minds are really being won.

The power of digital products and mobile applications to not only serve the customer, but also meet business needs by being able to track, understand and improve insight has made them a cornerstone of many financial services businesses.

“The knowledge you can glean from app data is incredibly powerful,” says Apadmi’s Senior Technical Product Manager Nitin Samani. “Lots can clearly be learned from web behaviour, but it’s not just about what people are searching for, it’s what people are actually buying.”

“Whether it’s surfacing customer insights, transaction analysis in the cloud or creating a data strategy around user trends, the potential is huge.”

Super app. Lifesaver or anti hero?

The combination of great insight and the ability to amalgamate multiple services in one overall experience is hard to ignore. But as services are being re-bundled, how is that taking shape?

Super apps aren’t yet taking over, but they’re clearly gaining good ground. No longer just the preserve of Asia with the likes of WeChat, Alipay and Kakao, the notion of aggregating multiple offers alongside financial services has firmly taken hold. Back to Revolut.

The UK-based start-up is leading the way from its fintech counterparts in terms of revenue (Revolut posted better numbers for 2022 than immediate competition Monzo and Starling) and diversification of services across shopping, travel, insurance and experiences.

This move into super app territory is also grounded in a strong sense of great CX. Vasily again to explain how:

Being delightful (“People will not use financial services apps unless those experiences are delightful.”)

Clarity and precision (“Clarity and precision is a must. Clarity is that everything should be clear to you as a customer. Precision is that everything you intended to do is what actually happens and is what’s best for you, i.e. avoiding fraud.”)

Efficiency (“People do not open digital banks and digital FS apps to have fun. It is painful to manage your money and we should understand that people just want out. They want to pay the bill or check the card number and then leave.”)

Room for one more?

But, I hear you cry, not every business can sustain a super app. Which is absolutely right. But the emergence of new ecosystems means that everybody is finding their way and working out which slithers of functionality they can own, either within their ecosystem, or somebody else’s.

Going back to where we started the unbundling story, the technology giants continue to make their presence felt. Some suggest that big banks are actually more worried about the likes of Apple and Google than they are smaller fintechs and taking a leaf out of their books might not be such a bad thing.

“I think banks have the ability to regain some control if they could be like the Apple Store (sic) for financial services,” suggests former CEO of BBVA Compass, Manolo Sanchez to the VNext Banking Remix podcast. “That’s where I think financial services have an opportunity.”

“At the end of the day they know the customer, they have the KYC. ‘I know this client and they can transact within my platform.’ But suddenly the client doesn’t want to use that brokerage, they want to go to Robin Hood. Or they don’t want to do international transfers and take five days to get through, they want to go to Wise and get it through in 24 hours. So to an extent they can enable the supermarket approach by being owners of the KYC element.”

The customer is always right

It would seem that having the lead the charge in blowing things up in financial services (and all industries for that matter), digital products are now acting as the catalyst to put things back together again. So whether you’re being bundled or unbundled, the constant remains the customer.

And the only way to really stay relevant is by making sure your digital products are working as hard as they possibly can to deliver your experience better than anyone else’s.

If you’d like to find out more about the work Apadmi does in financial services, we’d love to hear from you.

Share