Een succesvolle mobile banking app ontwikkelen

by Apadmi|Sun Feb 09 2025

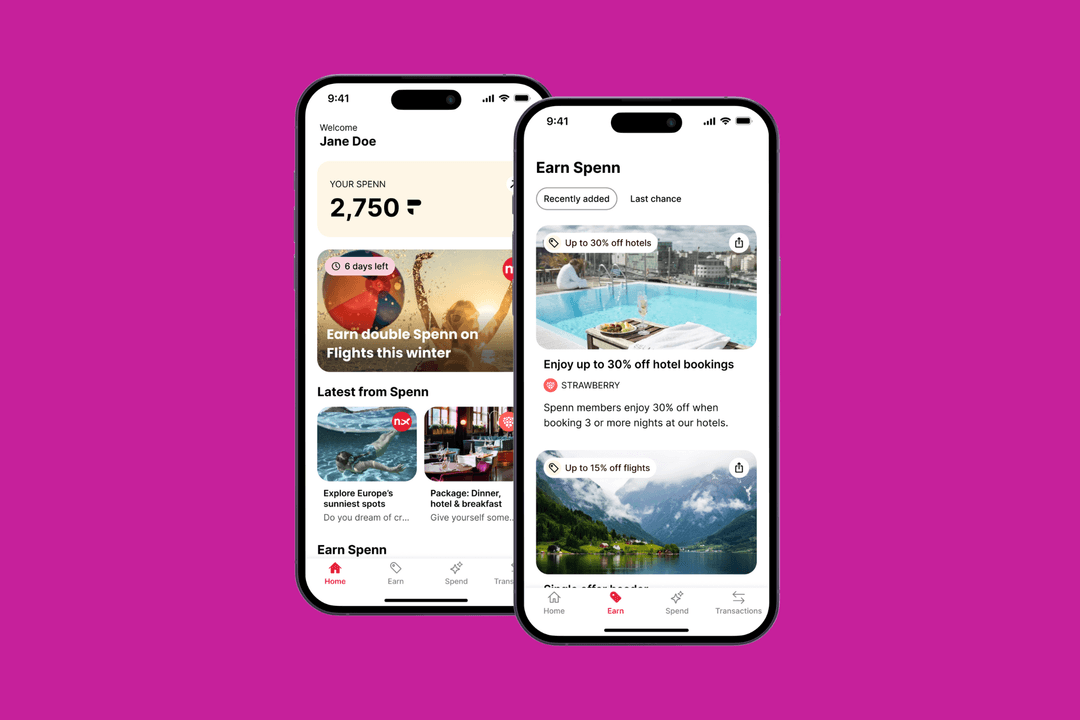

Voor banken en financiële instellingen is een robuuste, gebruiksvriendelijke banking app inmiddels geen nice-to-have meer, maar een must. Een goede app biedt niet alleen de juiste transactiemogelijkheden, maar zorgt ook voor een soepele, veilige gebruikerservaring die vertrouwen opbouwt en klantloyaliteit versterkt.

Het ontwikkelen van zo’n app vraagt om een goed begrip van de wensen van je gebruikers, slimme features die écht waarde toevoegen, en sterke beveiligingsmaatregelen om gevoelige data te beschermen. Daarnaast is het essentieel om ontwikkeluitdagingen tijdig aan te pakken en na de lancering continu te blijven verbeteren.

Begrijp je gebruiker

De sleutel tot een succesvolle mobile banking app? Inzicht in wat je gebruikers écht nodig hebben. Door diepgaand marktonderzoek en user behaviour-analyse ontdek je welke features onmisbaar zijn en hoe jouw app het verschil kan maken.

Wie is je doelgroep?

Een goede banking app begint bij een scherp beeld van je doelgroep. Denk aan leeftijd, digitale vaardigheden, financiële behoeften – of je nu mikt op jonge tech-savvy gebruikers of oudere klanten met andere verwachtingen. Onderzoek ook waar hun huidige banking apps tekortschieten. Zo kun jij die pijnpunten oplossen én opvallen in een overvolle markt.

Zet UX voorop

In mobile banking is UX een gamechanger. Functionaliteit is de basis, maar gebruikers verwachten een intuïtieve, snelle ervaring – van inloggen tot uitloggen.

Toegankelijke appdesign – Denk aan leesbare fonts, responsive design en een logische flow.

Snelheid telt – Een snelle app verhoogt gebruiksgemak en engagement.

Feedback ingebouwd – Laat gebruikers eenvoudig bugs melden of suggesties geven zonder de app te verlaten.

Kortom: een banking app moet meer bieden dan transacties. Het moet een vertrouwde digitale omgeving zijn die gebruikers graag gebruiken.

Onmisbare features

Een sterke mobile banking app combineert gemak, betrouwbaarheid en veiligheid. Goed doordachte functies maken dagelijkse bankzaken makkelijker en geven gebruikers meer grip op hun financiën.

Veilige login-opties

Biometrische verificatie (zoals vingerafdruk, gezichtsherkenning of stemherkenning) biedt extra gemak én veiligheid. In combinatie met wachtwoorden en 2FA ontstaat een meerlaagse beveiliging. Bij onze samenwerking met Chetwood Financial zorgden we voor maximale veiligheid zonder in te leveren op design of gebruiksvriendelijkheid – die balans is cruciaal.

Real-time notificaties

Geef gebruikers direct inzicht in transacties, saldo-updates, vervaldagen van rekeningen of verdachte activiteiten. Met aanpasbare instellingen bepaal je zelf wat je wilt volgen – transparantie op maat.

Eenvoudige transacties

Geld overmaken, rekeningen betalen of cheques scannen moet snel en foutloos kunnen. Denk aan peer-to-peer betalingen, geplande of terugkerende betalingen – allemaal intuïtief en veilig ingebouwd.

Financieel inzicht

Budgettools en uitgavenanalyses geven gebruikers grip op hun geld. Denk aan categorieën, limieten, waarschuwingen en visualisaties. De tools moeten persoonlijk, eenvoudig en interactief zijn, zodat je met één blik weet waar je staat.

Beveiliging als basis

Zonder sterke security is er geen vertrouwen. Een banking app moet data beschermen én bestand zijn tegen cyberdreigingen.

Data-encryptie

Sterke encryptie – zowel in rust als tijdens verzending – beschermt gevoelige informatie. Protocollen als AES en TLS zorgen voor een veilige standaard en geven gebruikers vertrouwen in je app.

Regelmatige security-audits

Doorlopende audits van code én infrastructuur (inclusief penetratietests en compliance-checks) voorkomen kwetsbaarheden en houden je app future-proof.

Multi-Factor Authentication (MFA)

Met MFA voeg je een extra laag toe aan je loginproces. Denk aan iets wat je weet (wachtwoord), iets wat je hebt (smartphone/token) en iets wat je bent (biometrie). Dit biedt effectieve bescherming tegen identiteitsfraude.

Regelgeving naleven

Voldoe aan wetgeving zoals de GDPR en PSD2. Dit garandeert niet alleen dataverwerking volgens de regels, maar versterkt ook het vertrouwen van je gebruikers.

Ontwikkeluitdagingen tackelen

Integratie met bestaande systemen

Een nieuwe app moet soepel communiceren met bestaande (vaak legacy) systemen. Ervaren IT-specialisten helpen je om via sterke APIs en middleware robuuste verbindingen op te zetten. Grondig testen voorkomt integratiefouten.

Schaalbaarheid vanaf dag één

Je app moet probleemloos kunnen meegroeien met je gebruikersaantallen. Cloud-oplossingen, load balancers en schaalbare architectuur zorgen voor stabiliteit – ook bij piekbelasting.

Altijd beschikbaar

Bankdiensten moeten 24/7 werken. Redundante systemen, failoverstrategieën en geografisch gespreide datacenters garanderen continuïteit. Klanten zoals Charles Stanley gebruiken onze monitoring en support om downtime volledig te voorkomen.

Testen, testen, testen

Een banking app moet altijd betrouwbaar presteren. Test daarom breed: functioneel, qua performance én op security.

Functioneel testen – Werkt alles zoals het hoort? Denk aan registratie, inloggen, transacties. Automatische tests simuleren gebruikersgedrag.

Security testing – Van SQL-injecties tot XSS: risico’s moet je vóór zijn. Test regelmatig en grondig.

Performance testing – Hoe houdt je app zich onder druk? Simuleer hoge belasting met load-, stress- en spike testing om je app stabiel te houden.

Lancering en verder bouwen

Een app bouwen is één ding, maar een sterke launch- en groeistrategie is minstens zo belangrijk.

Slimme marketing

Combineer digitale en traditionele kanalen om je app te lanceren. App Store Optimization (ASO) helpt je zichtbaarheid én betrouwbaarheid te vergroten. Een hoge rating is goud waard.

Feedback is goud

Creëer in-app mogelijkheden voor bug reports, feature requests en suggesties. Combineer dit met surveys, focusgroepen en social media monitoring om te leren wat werkt. Voor Chetwood Financial ontdekten we via user feedback dat 97% van de gebruikers ‘tevreden’ of ‘zeer tevreden’ was met hun app – waardevolle inzichten voor verdere ontwikkeling.

Regelmatige updates

Blijf updaten. Nieuwe features, bugfixes en OS-compatibiliteit zorgen dat je app relevant blijft. Werk met een duidelijke roadmap en monitor prestaties continu.

Apadmi als partner

Een mobile banking app bouwen vraagt om focus, expertise en een betrouwbare partner. Bij Apadmi begeleiden we je van concept tot doorontwikkeling – met security, UX en innovatie als rode draad.

Klaar om jouw banking app te realiseren? Neem contact op – we denken graag met je mee.

Share