Does less friction mean more fraud in financial services?

Technology and digital products are having to strike a balance between keeping customers happy and keeping fraudsters at bay.

Fraud and financial services are long time bedfellows. The ever-changing landscape of fraudulent activity makes for an ongoing game of cat and mouse that is extremely hard for businesses to stay ahead of.

There is a need for constant evolution from both a regulatory process and digital product point of view.

The rapid onset of fintech has accelerated the adoption of digital products and as of June last year the valuation of FinTechs in Europe represented almost €430 billion, which is more than the combined market capitalisation of Europe’s seven largest listed banks.

Increased digital activity has made life considerably easier from a customer perspective, but by the same token it also presents increased opportunities for fraudsters.

The amount of fraud loss in the UK in 2022 was £1.2 billion, which was actually down from the previous year by 8%. But while the level of fraud is decreasing, the number of ways in which people are being defrauded is on the rise.

Last year according to UK Finance, payment card fraud accounted for 45% of losses, but the perennial frontrunner was run close by APP (Authorised Push Payment) fraud which accounted for 40%. That’s when people have been successfully persuaded to authorise payments to people they shouldn’t.

Unsurprisingly this isn’t being taken lying down. Indeed it’s not just on the financial services agenda, but also the government’s. An estimated £30 billion will be spent on AML (Anti-Money Laundering) regulation alone in 2023, a quarter of which is on technology and a third on people.

This combination of technology and people is important. We need technology, but we also need people to create and implement it. More on the human-tech relationship later.

But even with investment, other things are also getting in the way of fighting the good fight.

More barriers means more frustration

Putting up greater barriers with more layers of protection is increasing the number of steps customers have to go through and has the knock on effect of increased frustration and larger amounts of data to house, which is creating its own headaches.

There is also the legacy effect. Historical processes often mean internal teams will be doing things in their own ways - different processes at different parts of the journey across on-boarding, transaction and authorisation stages, making things disjointed and creating silos.

So how are good digital products and technology helping?

While the talk around ChatGPT and generative AI is deafening, the reality is financial services companies have been using AI and machine learning very effectively for some time to monitor the way people interact with digital products. The creation of behavioural proofs to back up identity and ensure customer activity is consistent with usual behaviour is now almost entirely automated.

It has become a volume game and automatic flags when traditional AI algorithms spot anything outside of the norm are already saving billions.

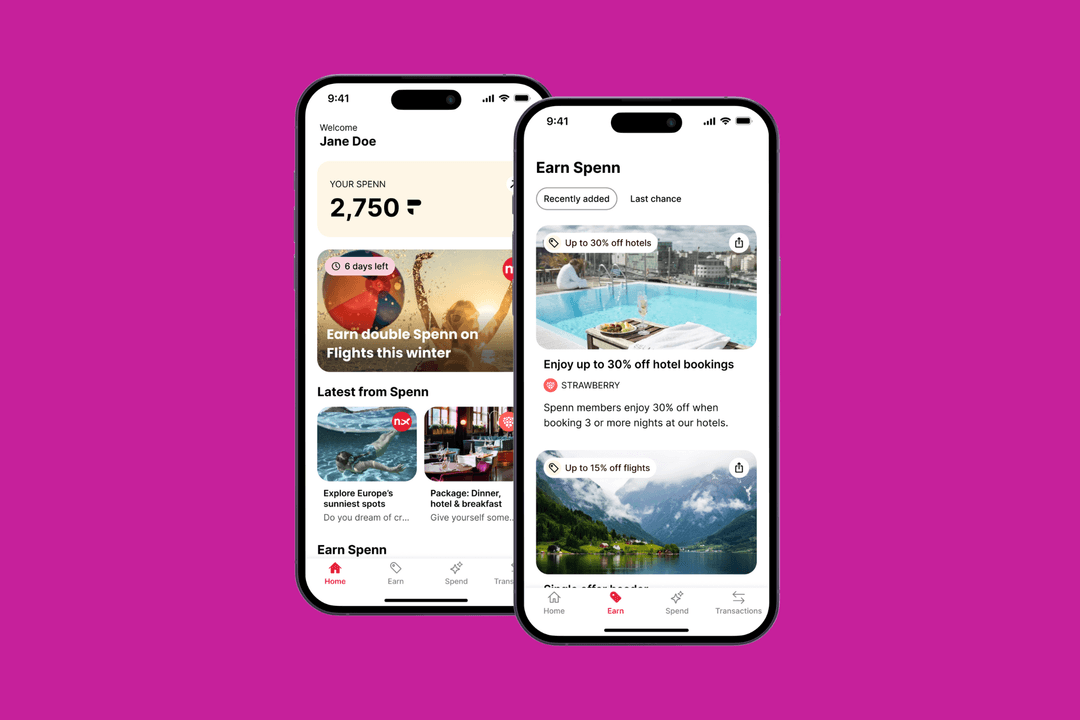

Apps are of course another area making a big difference. From the simple, straightforwardness of the Monzos and Starlings, to the land-grabbing Swiss Army knife super apps of Wechat, Kakao Talk and closer to home, Revolut.

They are easy to use and have a low barrier to entry, but there are doubts over their robustness compared to the single use apps of longer standing banks which have built their heritage on security. Nevertheless, high expectations of easy customer journeys is exacerbating the ongoing struggle between maintaining high security levels but lowering barriers for customers.

Humans can be the weakest link

Financial services are striving to meet human demand by making journeys as easy as possible, but often it can be humans which are the weakest link in the chain, as already demonstrated by the rise in APP fraud as mentioned earlier.

This is compounded by the expectation of both increased personalisation and the desire to make our banking journeys as easy as possible.

Standard processes to combat fraud are a thing of the past. There is no longer one size fits all on either side of the coin - for customers or for businesses.

Personalisation works both ways

Customers expect banks to know who they are and what their needs are and deliver a tailored experience accordingly. Similarly, banks are expected to put in place measures to know with absolute certainty that the person on the other end of a transaction is actually who they say they are.

Coercive behaviour or social engineering is very effectively creating situations where a fraudulent transaction feels normal to the customer. Half the battle can be convincing people that the transaction they are trying to make is actually untrustworthy.

Technology in the shape of well-crafted and closely monitored digital products can help to combat that.

Tracking usual behaviours and mapping interactions including movements across a page, scroll speed, keystrokes and mouse movements all helps to build up a pattern of behaviour personal to an individual. Personalisation isn’t just about making the customer feel good about their experience, it’s also helping organisations to detect abnormal activity.

Educate with positioning and good UX

There’s also an opportunity to be creative with the way in which warnings are presented to customers. Standard messages and questions asking whether we “really want to make this payment” can quickly be ignored when seeing them for the third or fourth time.

Education and positioning is key to avoiding blindness to necessary reminders. Good copy and interesting approaches to UX can go a long way to helping users re-engage with steps which are essentially there to maintain the levels of security we all expect.

The struggle between maintaining the easy experiences which have made managing our money easier, while also fighting fraud in financial services isn’t going away anytime soon. But having the right digital products in place can help move towards not just being friction-less, but friction-right.

If you’d like to find out more about the work Apadmi does in financial services, we’d love to hear from you.

Share