Behavioural science, data and tech in Financial Services

by Sam Shaw-Finance Journalist|Thu Jul 30 2020

As a mobile technology agency, we’re increasingly being asked about the role of artificial intelligence and tech in Financial Services – how can behavioural science data be used to better predict patterns in customer behaviours?

Can wealth management companies use mobile apps to deliver better, more relevant and timely content? How can AI deliver a better experience, and how does this impact UX design? There’s a lot of talk about digital transformation – how important is the role of data in delivering new mobile and web products to the investment sector?

To understand more, we asked Sam Shaw to talk to digitally-focussed industry leaders, about the real opportunities for data and tech in Financial Services.

Behavioural Science & The Power of Persuasion

In classical mythology, Homer’s Odyssey recounts how, when sailing past the Sirens’ island, Odysseus ordered his crew to plug their own ears and tie him to their ship’s mast, such was his curiosity over their beautiful, yet ultimately fatal, song. Despite begging to be untied, the sailors ignored their boss’s pleas, tying him even tighter until they’d passed safely out of earshot.

That example of how short-term desire can supersede longer-term sensibility, is referred to by behavioural scientists as ‘present bias’. In being aware of it, Odysseus’s crew saved his life – but when it comes to the financial sector, what measures can be put in place to override some of our inherent human behaviours, and how can data help?

Data and tech in Financial Services

As “open banking” expands into “open finance” – stretching to mortgages, consumer credit, savings and investments, pension accounts and general insurance – the data opportunity appears almost limitless.

Captured and used responsibly, even the City watchdog has identified its potential, suggesting open APIs will allow third parties to create financial products, services and mobile applications. These would leverage customer data in a less siloed fashion than ever before, leading to innovation through the use of apps and digital wallets.

Deciding what, when and how to use data to create more meaningful client experiences without moving into ‘Big Brother’ territory is the sector’s clear challenge. As Chief Digital Officer at Hargreaves Lansdown, Chris Worle said: “We’ve got this great insight, but how do we use it at scale?”

Worle said a recent use-case related to Covid-19 and the ensuing market troubles. “We know which clients would typically panic-sell in those circumstances. Obviously, we can’t stop them doing that, but we can anticipate it, get some timely content to them to hopefully reassure, and get them thinking about things differently.”

Charles Stanley is also increasing its efforts in this direction, with ambitions of capturing more data to help it produce more personalised, relevant content – but also, to help the business discover whether clients are achieving their desired outcomes. And, if they aren’t, what options are available to help them?

Paul Searby, interim Head of Digital, used the example of a self-directed client, whose fairly high-risk strategy wasn’t performing very well – they might be sent an educational piece around attitudes to risk, or how to build a more diversified portfolio for the longer term.

Staying one step ahead of the customer journey

Unlike many other sectors, the financial services road is long.

Firms might start capturing someone’s digital footprint months, or even years, before they eventually become a client, often taking routes that are neither logical nor linear.

People rarely arrive with one clear brief to create a holistic life plan; it tends to happen in stages. As such, Worle sees the digital future as an equally fragmented experience. “I don’t see a big monolithic AI where you put in your life and it spits out a solution […] I see it being more about how we provide individual tools to help clients solve individual challenges. ‘Show me the parts of my portfolio that are unbalanced and some alternatives.’ ‘Show me smart projections for my pension going forward.’”

The need for greater personalisation (and high expectation of that experience) is a growing theme amongst wealth management consumers. Increasingly time-poor and overwhelmed by messaging, they demand their experiences to be relevant, timely and engaging in order to cut through the noise.

But, tailored content is only one side of it. Data can also be used to improve operational efficiencies.

One large financial advice firm has been working with a consumer credit agency to take clients’ publicly available data to help understand their behaviour (referred to as “propensity to purchase” or “propensity to engage”) and combine that with information held by their financial adviser.

For instance, if they had taken out an investment bond valued at £100,000 it could lead to one of several scenarios. A sales director at the company told me: “We can tell a couple of things and categorise them accordingly. For instance, if they’ve given us £100,000, do they have any more money to invest? If they have more money, are they the type that are likely to invest with us – a group of financial advisors, or not? If they aren’t, are they likely to go to a bank? Will they go to a robo-offering, or will they go to a self-directed platform?”

Such insights help anticipate likely behaviours, which then allow his team to prioritise their time more effectively.

Tackling “behavioural bottlenecks”

Where data scientists might believe providing such information or economic incentives could change behaviours, behavioural scientists look at the world differently.

James Guszcza, US Chief Data Scientist at Deloitte Consulting who inspired the Odyssey example, said: “Instead of trying to make people more rational by giving them an optimal amount of information, let’s take people as they are and just change the landscape around them to make it natural.”

Many digital wealth offerings pitch themselves as a quasi-‘Siri for your bank account’, he said, with the use of voice responses, real-time modelling and natural language processing increasingly on the horizon.

But if people resist their financial projections because they relate to their ‘future self’ and therefore fail to resonate, even the slickest design efforts are wasted.

If people’s egos lead them to believe they should hold out for a lower entry point before investing, they might miss out if prices bounce.

Applying behavioural principles, bringing together data, digital and design, leads to true customer-centricity. By understanding “behavioural bottlenecks” such as forgetfulness or letting short-term pleasures trump long-term goals, predictive models – which Guszcza likens to credit scoring models – could identify in advance which customers might be more receptive to certain messages, or information presented in a particular way.

Behavioural tactics include local comparisons, often used by energy companies that peg you against your neighbours. Switching to opt-out from opt-in saw 10 million new people in the UK saving for retirement when auto-enrolment was introduced by the government, known as a “smart default”. Altering a mobile app’s display to prevent people thinking about short-term fluctuations in the market, and more in terms of long-term decision-making, might make all the difference.

Guszcza said we can “redesign our digital environments to go with the grain of human psychology” – which sounds far less cumbersome than tying ourselves to a ship’s mast, but metaphorically speaking, might help save us from ourselves.

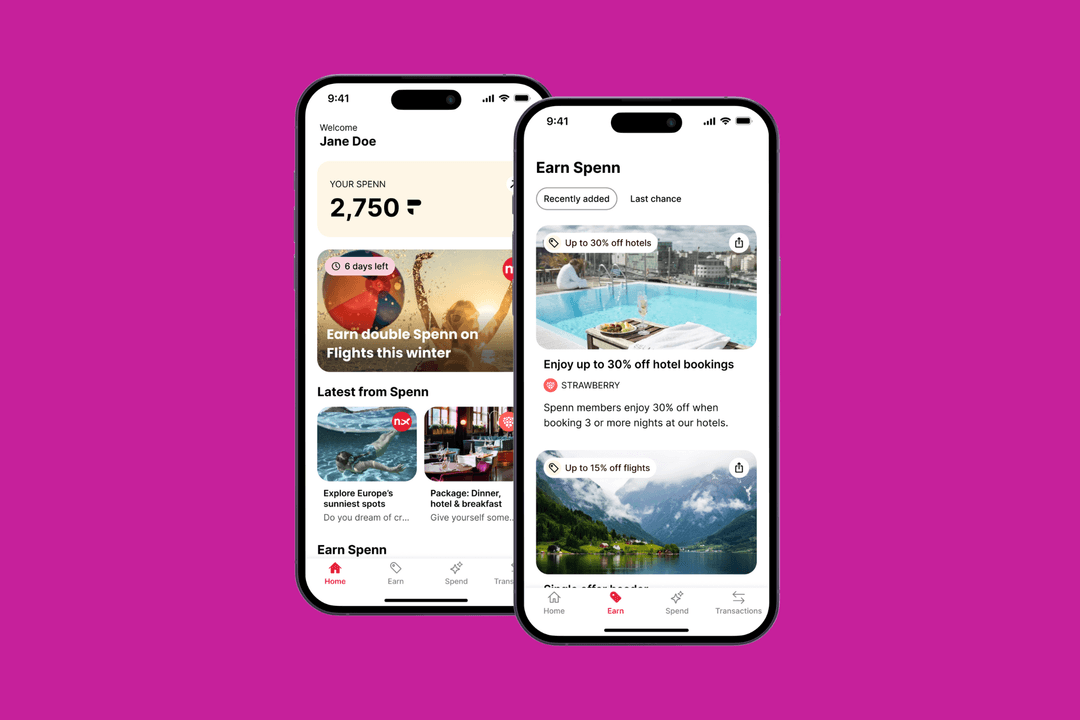

So, it’s clear that there’s a role for tech in Financial Services – and an opportunity, along with the desire, for data analytics to innovate. At Apadmi, we’re fascinated by what’s coming next and can see huge potential for a new, intuitive relationship between wealth managers and their clients, through mobile apps and other connected devices.

We’re specialists in securely integrating complex systems with innovative, easy-to-use digital experiences for organisations as diverse as Charles Stanley, BBC and Chelsea FC. If you’d like to learn more about the possibilities for AI in your business, and how to pre-empt the behaviours of today’s mobile investors, contact us to learn more about our work in this field.

About the author

Sam Shaw has been a financial journalist for 15 years, holding senior editorial positions across the B2B press, including editor of Financial Times Business’s flagship investment title.

She now works as a freelance writer, editor, content producer and presenter, across trade and consumer media.

Share