Adobe Digital Trends 2021 Financial Services & Insurance report spotlights the need for mobile

by Apadmi|Tue Mar 17 2020

The Financial Services industry might be one of the most volatile post-Covid sectors.

As we learned in our recent interview with Raisin CEO Kevin Mountford, Covid has fully disrupted the sector, and many companies are trialling a variety of new services to regain their customer base.

With that in mind, we were particularly interested in the recent Digital Trends 2021 Financial Services & Insurance report published by Adobe. The report pools opinions and polls from over 700 professionals in the financial services and insurance industries.

We’ve broken the report down and highlighted a few key insights we think will help inform your company’s digital strategy in the coming months.

The increase in digital adoption over the last year

The average amount of time people spent on their phones in 2020 increased by as much as 40% during the pandemic, as COVID forced many to move aspects of their lives on to digital platforms.

This shift towards digital has had knock-on effects on several industries – and financial services are no exception.

The Adobe Digital Trends 2021 Financial Services & Insurance report opens with a series of results around digital adoption within the sector over the last six months:

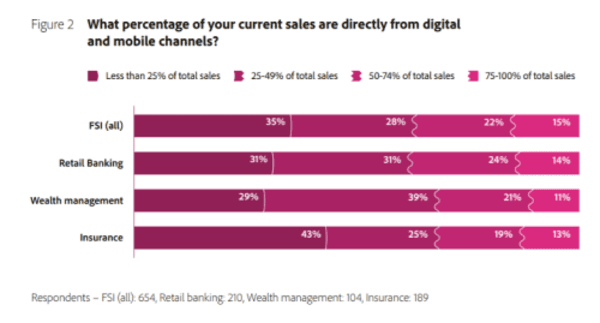

These results clearly indicate a shift in the financial services sector as 54% of those polled identified an unusual growth in digital/mobile visitors. Additionally, over 37% of the FSI identified more than 50% of their current sales as coming from a digital or mobile channel –a clear indicator of the growing importance of mobile offerings within the industry.

There’s a seismic shift in behaviour towards mobile, and financial services must react to stay relevant. If your business has a weak mobile and digital proposition, it’s clear that 2021 is the year to strengthen it.

Digital transformation within the finance industry

Many companies within the Financial Services sector have already recognised the need to strengthen their digital platform. With several new entrants and neo-banks joining the market in 2020, there’s been a clear challenge for many traditional institutions. Adobe’s next section of their report looked into how Financial Services has been innovating in the last few years:

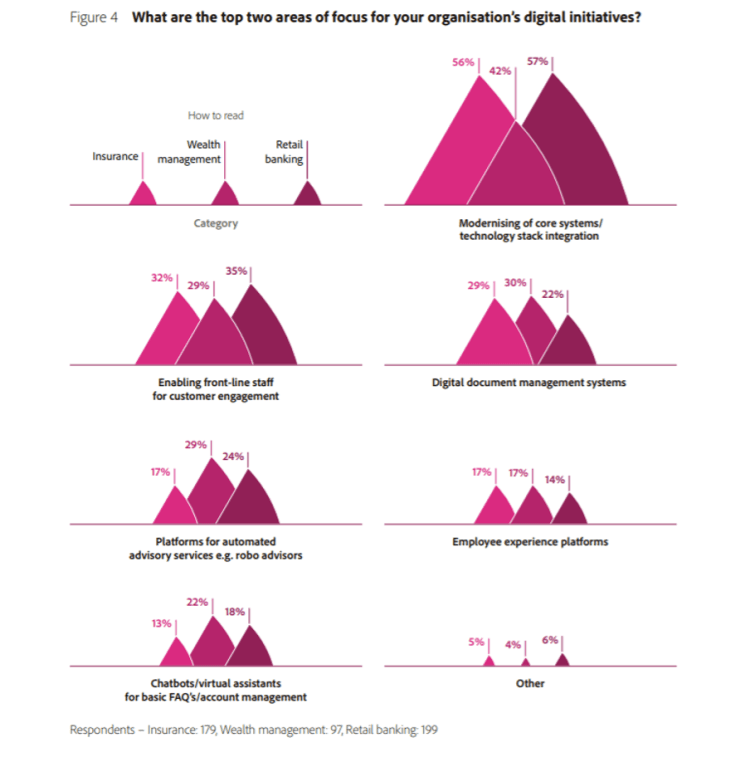

There are a lot of interesting stats to pull out here – here are a few that stood out to us:

The focus on modernising core systems across financial services

Growth in automation and chatbots within the Wealth Management space

The enabling of front-line staff and digital document management systems

There’s a clear trend here within the industry around internal systems and digital transformation. This creates a natural gap in the market for Financial Services businesses that put the customer experience first – those who maximise on this opportunity will be the ones to pull away from the pack and and find success in 2021.

Current data collection techniques

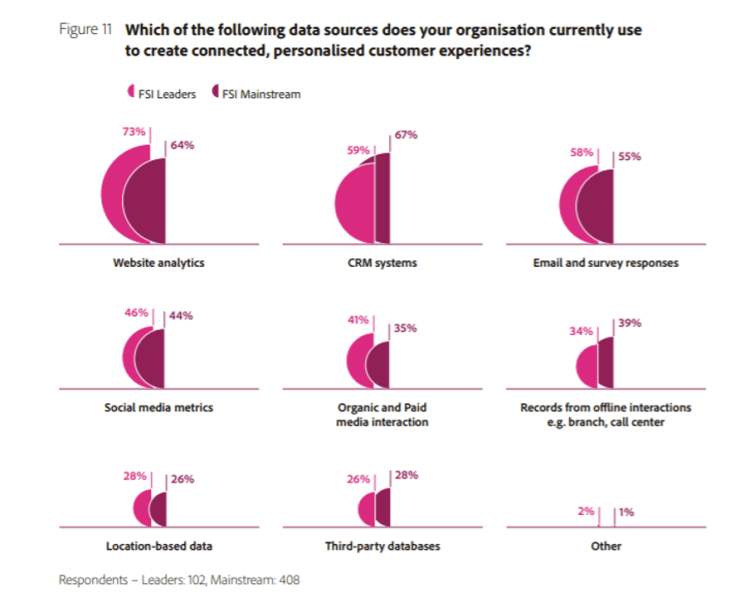

The next section of the report focused on the data collection techniques employed by financial services companies, and the amount of insight they have into different aspects of their business and revenue streams:

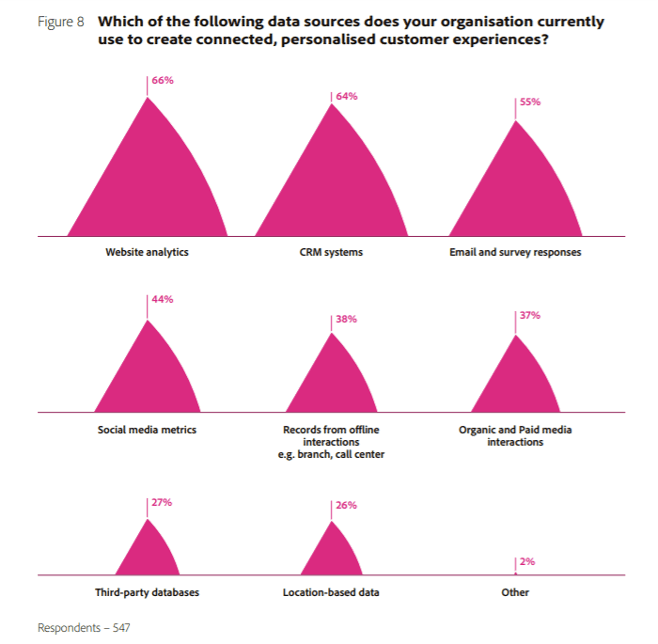

This section is particularly interesting. It highlights several gaps regarding data collection within the Financial Services industry as a whole. It’s clear that traditional digital marketing analytics are used within the sector, including web analytics (66%), CRM systems (64%) and email/survey responses (55%).

However, the lack of data in social media metrics (44%), records from offline interactions (38%) and location-based data (26%) indicates a lack of a single customer view.

We recently covered the importance of a single customer view within the retail market, and it holds many insights that ring true for the Financial Services market too – such as the need to follow the entire customer journey, identifying behaviour across all forms of interaction within your mobile and digital portfolio of solutions, to gain a well-rounded understanding of the full customer journey.

A single customer view would also improve visibility, as 20% of those polled claimed to have little or no insight into the journeys of new customers, and 31% claimed the same when it came to the mindset of customers throughout their journey.

What makes a leader in the Financial Services industry?

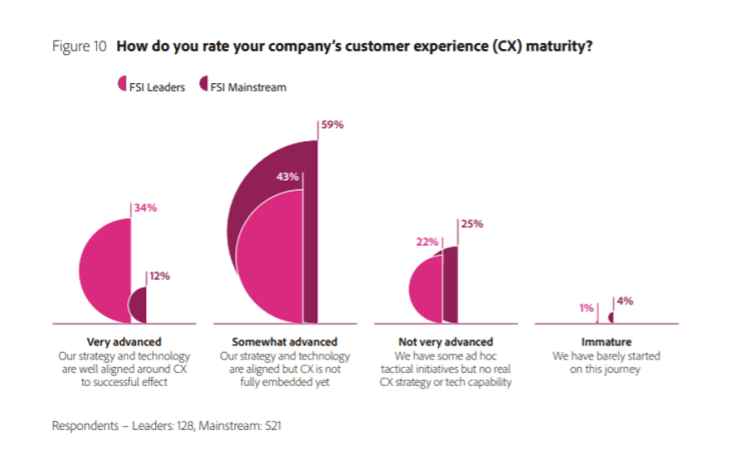

The final section of the report split out sector leaders (ie those that had significantly out-performed their competition in the last six months) from the rest of the group, in an attempt to identify the winning trends and behaviours within the industry:

Here are a few stark differences we took away from this:

Focus on customer experience - Almost three times as many Financial Services leaders (34%) claimed their customer experience was ‘very advanced’ when compared with the rest of the sector (12%), supporting our previous prediction that a user focus will outperform many companies focused on internal digital transformation over the next 12 months

A greater focus on data - With a few notable exceptions, Financial Services leaders demonstrate a greater focus on data across the board. This complements the customer experience focus; it’s clear that these sector leaders have a greater view of their customer and can better tailor their offering to the needs of their users

Less reliance on third-party data and CRM - The industry leaders take more data directly from their customers through web analytics (73%), email responses (58%) and social media metrics (46%) than the rest of Financial Services, and use both CRM (59%) and third-party databases (26%) less than their competition. This highlights a more bespoke digital approach, and less of a need for traditional ‘cold calling’ techniques.

Apadmi have helped many companies improve their current mobile and digital customer experience, creating views on customer behaviour and helping companies adjust their offering to the needs of their clients.

We offer several services including app refresh and data integration that could help support financial services that want to follow in the footsteps of the industry leaders.

Our key takeaways from the report

The Adobe report on Financial Services & Insurance had a lot of interesting data for the mobile and digital sector, and certainly offers guidance to Financial Services in the coming months. Check out the full report for all the detail, but our quick summary:

A shift in Financial Services has increased sales on mobile and digital platforms

There’s a greater need within the industry for digital transformation with regards to the customer journey and experience

Many companies are focusing on internal digital transformation, creating a gap in the market for those companies with a customer experience focus.

Share