What challenges can insurers overcome with mobile?

by Vino Nandagopalan-Financial Services Growth Director|Wed Mar 26 2025

Insurance companies are facing an increasingly competitive landscape where customers expect more convenience, transparency, and personalisation.

For many, this convenience and personalisation can be achieved through a robust app strategy and a seamless mobile experience. Mobile as a platform addresses a wide range of needs for both customers and businesses; from streamlining policy management and claims processes to investment tracking and accessing health services.

But what does an effective app strategy look like for insurers to overcome common challenges, and what sort of value can they expect to unlock? Apadmi's Financial Services Director Vino Nandagopalan explores further.

Consolidating multiple experiences

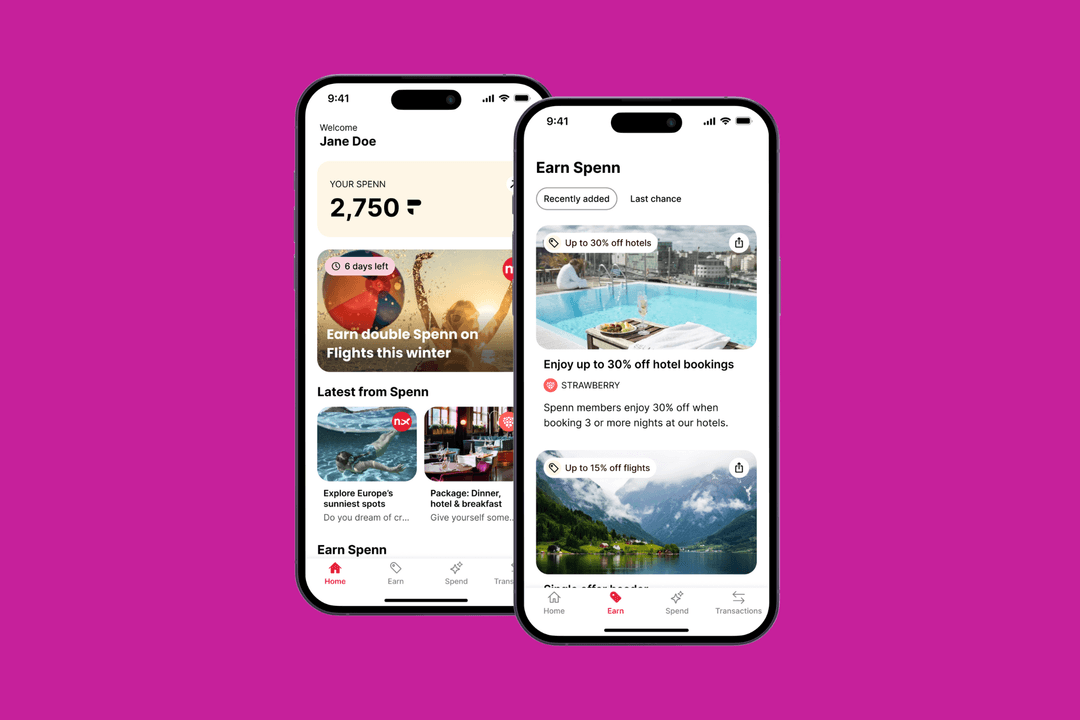

Consolidating multiple apps into one unified mobile experience has quickly become a well-adopted strategy across retail, telco and financial services businesses.

Historically, insurance providers that offer a variety of services such as health insurance, travel insurance, life insurance or investment management programmes may have had different mobile experiences serving each area. However, this can lead to fragmentation and a disjointed user experience, creating frustration for customers who must navigate multiple platforms to manage policies, plans or investments.

By consolidating these services into one responsive, dynamic app, insurance companies can offer a seamless, integrated experience that improves user satisfaction and engagement. It can also give insurers a bigger opportunity to cross-sell and up-sell services which customers may not have been previously exposed to.

Unlocking more personalisation with greater data

Mobile apps allow for much more effective data collection and analytics compared to their web counterparts. Building a comprehensive data analytics dashboard into your mobile app can give you a far deeper understanding of customer behaviour and preferences, allowing you to implement greater personalisation.

Collecting the right data from the start is crucial - some organisations skip implementing more advanced analytics and data dashboards when looking to get something to market in a rush, but this can be a costly mistake in the long run. Investing in more comprehensive tools from the start allows you to build a better picture of your customer, their behaviour and their preferences from the get-go. Tracking everything from number of sessions to frequency of app opens and time spent on specific pages can help feed future personalisation.

This personalisation can then unlock value for the customer, who will feel as though more relevant content is being served to them based on their needs and interest, whilst unlocking value for the insurer who can increase conversion when it comes to cross-selling additional services and products.

Increasing customer engagement and retention

When it comes to insurance products, continued customer engagement and loyalty has been a long-time battle for many businesses - after all, unlike our weekly food shop or monthly electricity bill, many policies are annual and not at the top of our minds on a regular basis.

This is where mobile can step in. Insurers can utilise strategies such as gamification to maintain more regular engagement with their customers, taking the customer away from the traditional annual relationship with the insurer. Utilising push messaging allows insurers to send timely, relevant messages that encourage more regular engagement, reducing the cost for an insurer of inbound activity and opening up new opportunities for communication.

Improving payment channels, reducing costs

For any financial services business, providing a new payment channel, or improving an existing one, can allow customers greater ease and flexibility when making and managing payments. It can also help to increase transactional value while reducing incoming calls to contact centres and decreasing fraudulent activity - as our client Argos Financial Services found.

Insurers are no exception here. Mobile apps can provide a seamless channel where customers can self-serve, whether that be accessing help via chatbots or adjusting payment methods. Effective self-service channels greatly reduce strain on business resources - so ensuring your app is continuously providing frictionless experiences is key here. Continuous optimisation, monitoring and maintenance is crucial to keep your app in top shape and to avoid downtime or poor user journeys which can create costly inbound calls.

Providing security, privacy and trust

Our recent finance app report found that trust is a huge issue for consumers when it comes to online money management. For insurers, trust is key to ensure policyholders feel safe and secure sharing their sensitive data with you and your platforms.

Mobile apps can help alleviate some of these concerns - data encryption and data masking should be implemented as standard in a quality mobile product, giving your customers peace of mind whilst protecting your business from unwanted data breaches and attacks.

Apadmi’s mobile experts can help insurers navigate the technical complexities of building a well-designed app that meets regulatory standards. We deliver scalable, adaptable mobile platforms that meet both future business needs and current customer needs - find out how we can help you unlock value with mobile today.

Share