The evolution of digital solutions in insurance

by Sam Shaw-Finance Journalist|Thu Feb 03 2022

Assured Futures is one of the UK’s leading specialist life and health insurance intermediaries, specialising in producing bespoke solutions for partner companies and websites. As a business with a first-class reputation among the industry and its clients, we wanted to seek the views from its leadership team on how digital innovation is shaping the future for the insurance sector.

To delve into the topic, we engaged the help of Financial Journalist Sam Shaw, who spoke with Assured Futures’ Commercial Director Ian Sawyer.

How would you describe the evolution of digital solutions within your sector?

Slow. I think the life insurance industry is behind because it’s more individualised and complex.

When you insure a car, or a house, it has dimensions, characteristics and is made from materials that you can categorise: its speed, its cost or its size. You can ask certain questions to determine what sort of risks it poses; it's far easier to capture relevant data. It’s quite different when insuring your life. You can have two twin brothers who are statistically the same; same age, height, genes… But depending on their lifestyle, one could be 10 stone and one 20 stone. Their life choices then result in different circumstances, state of health, heart conditions, propensity to stroke. It’s not as easy to box people into categories as it is inanimate objects or pieces of property.

A deeper dive

Years ago, insurers would ask some questions, identify the real difficult cases and go and look at them in more detail.

Over the last 20 years, as insurance companies have brought digital services into the business, now we drill down by asking a lot more questions about your health – a real deep dive. Depending on the answers to those questions, now insurers use technology to rate the risk.

Taking the human out should make things quicker but [because of the process needed to gather the same amount of information] the digital transformation, as it stands, has actually made everything longer and more complex than it was 20 years ago.

The challenge is, therefore, in gathering very personal data by non-personal means?

When serving customers digitally, there's a limitation on what you can do, because you need to collect all this information, where some of the questions are quite intrusive and difficult. Take mental health, for example. It’s such a huge topic and I can understand that insurance companies are trying to identify those who may be potential future risks. Yet everybody can have mental health issues, often triggered by bereavement, personal issues or work stress, which may be temporary. But insurers tend to look at these issues now and make a judgement that if you have suffered, you're always going to suffer, which is not necessarily true.

The underwriters ask a lot of questions, many of which are highly sensitive. Drilling into such a level of personal detail frustrates us as a broker – we have to collect all this information when all we want to do is make it easy for the customer to get the protection they need.

Is there a challenge in life insurance being something that people need as opposed to other financial products that people tend to want?

Exactly. The challenge we always have with life and health insurance is convincing the customer to spend their hard-earned cash on a policy against a backdrop of them thinking ‘it will never happen to me’.

If we’ve learnt one thing from the pandemic, it’s that people have realised that bad things can and do happen – to all of us.

You have to have car insurance – it’s a legal requirement. House insurance isn’t mandatory but pretty much everyone who owns a house has it. You go on holiday – you take out travel insurance. More people insure their pets than themselves.

Those parts of the market have moved on, digitally.

The overarching challenge facing our part of the market is that identifying risk is harder because of people being more individual, yet taking out those individualisms could lead to an increase in prices. Because the crux of a life or health insurance policy is pretty much the same across the board, each insurer is vying for a level of granularity that means they can get a slightly better price for their customer, in turn acquiring market share. It makes it really hard for brokers.

What is piquing your interest, innovation-wise?

I think one real potential step forward relates to NHS records. Insurers obviously ask loads of questions about medical conditions and if they need more information they write to the doctor for a GP’s report (GPR), which can take weeks.

But in the past few years we are seeing the adoption of electronic health records (EHRs). If your local surgery has adopted the right technology, the medical report can be serviced electronically, which is less work for the GP and easy to access for the insurance company.

Changing dynamics

If we can get everybody adopting these, perhaps we can start changing dynamics. It will mean that even if your answer is a negative one, you can get back to the customer quicker and know what you’re all dealing with.

It also means that if we have access to the medical records (with the customer’s consent), we can all ask fewer questions on the medical side and just pick up on the lifestyle questions, fast-tracking the process. Digital health records are going to be critical to our business going forward.

How widely rolled out is that technology at the moment across the UK?

A year ago, around a quarter of the market was using these online systems – now it’s about 40% of practices. And there isn’t just one system, there are a few. We’re trying to encourage all insurance companies to have a starting point of asking for the EHR, and then only write off for written requests as exceptions where necessary. Where are the pain points in the work that you do? It mostly comes down to the need to collect detailed, intrusive, unpleasant information from the customer.

Years ago, your mortgage adviser or financial adviser would sort out your life insurance. Think about it; helping somebody get a mortgage is a positive action. Helping someone invest their money, or putting a pension in place, is positive. These things are all about building for the future and positive feelings. These people who are best-placed to be selling the insurance are not doing so to the same extent – largely, because it’s not a pleasant conversation. We’re talking about death, illness and health concerns.

Making that whole process easier is key to everything, so what would excite me is how we can use technology to collect some of that information.

Digitising the dirty work

I saw an app a couple of years ago that was developed in China, where just by looking at your face the app could read your temperature, height, weight and resting heart rate, which could then all be sent automatically into an insurance application form and speed up the process. If we get to a point where we have access to proper online national health records, we will know instantly if anyone has any kind of rating.

It happens with car insurance. We don’t need to ask what car you drive, how fast it can go and whether it has had an MOT because it’s all held on the database.

With human beings, we don’t have that level of national data that helps move us in that direction for the future. That’s what I hope is happening by the time I retire. I don’t have a lot of faith that it will happen in the next five or ten years, but I’m hopeful.

Where does mobile technology feature?

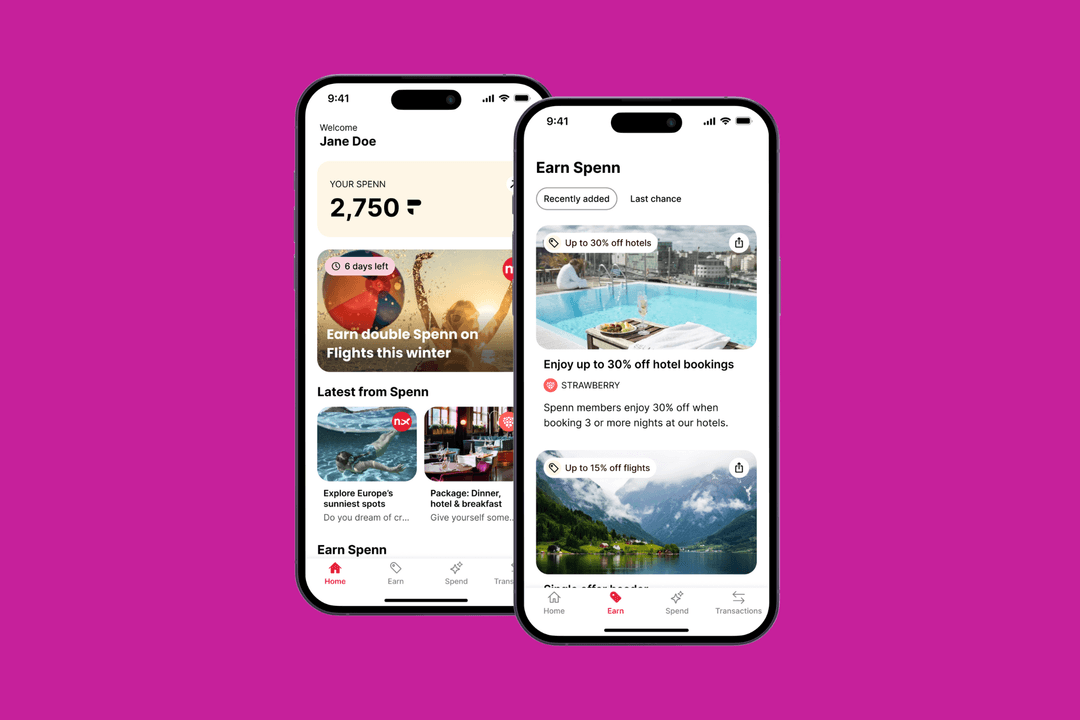

Part of the work we do at Assured Futures is running certain services for the price comparison websites, so whenever we’re designing a customer journey, everything is designed mobile-first because we know that 50% of traffic is now via mobile.

The simpler the journey, the more mobile-friendly it will become. When you’re designing customer journeys, you design things in a different way. It’s not a linear list of questions. It comes up one question at a time on screen, which we call one topic per page.

So, we know customer journeys are heavily influenced by mobile. I think it will become easier to say: take a picture, from that we can take certain information, from measurement devices on mobile phones they are able to determine height and weight from a picture of me standing, or using facial recognition to help determine certain physical attributes. The whole process speeds up because more information is being delivered digitally.

If you're interested in learning more about how a solid digital strategy can help mitigate and navigate some of the challenges the insurance sector is facing, get in touch with Apadmi.

Share