Growing customer expectations in Financial Services, and how tech is rising to meet them

by Coen Doolaard-Growth Director Benelux|Wed May 21 2025

Growing customer expectations in the Financial Services industry leave many businesses with the challenge of balancing innovation with trust, agility with security and modern experiences with legacy infrastructure.

As we prepare to attend Money20/20 in Amsterdam in a few short weeks, we’re hearing a common theme from leaders across banking, fintech and payments: technology can (and must) be a key part of the solution when it comes to meeting customer expectations.

Ahead of Europe’s leading financial services conference, we’re taking a look at how businesses can optimise customer mobile experience in order to keep up with these growing expectations

Time spent on mobile is at an all time high - make it count

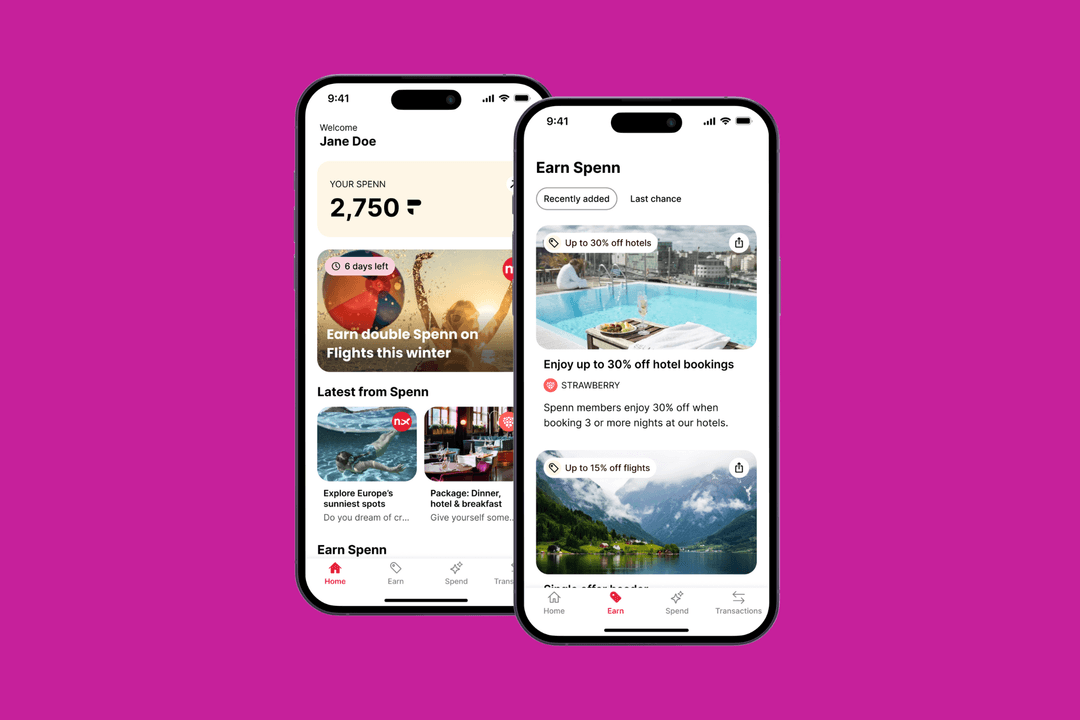

Modern financial customers expect real-time, mobile-first, and hyper-personalised service. Anything less risks frustration or churn, especially when so much time is spent on devices.

90% of smartphone time is spent in apps

75% of financial services customers want easy self-service options

72% of users also rate personalisation as “highly important”

Delivering intuitive mobile experiences that put the customer in control is crucial to meet these needs; from onboarding and KYC to managing finances and getting support. You need to translate behavioural insight into smarter journeys that drive satisfaction and trust.

Stop letting legacy infrastructure hold you back

Many banks and insurers still rely on complex, outdated core systems, making innovation slow, costly, and risky. These legacy systems are not only frustrating for businesses, but also for end users. Overhauling these systems can feel overwhelming; but modernising doesn’t have to mean replacing everything overnight.

Creating modular, mobile-first solutions that integrate with legacy systems while enabling new capabilities is one way that many businesses are looking to overcome this challenge. Decoupling the backend and frontend of your app whist implementing new middleware can allow for a temporary solution to quickly improve performance whilst you work on a full product re-build to replace legacy infrastructure.

This is something that we have been working on with leading wealth management organisation Charles Stanley, who were looking to swiftly improve the existing experience of both their mobile products built on legacy technology. In the meantime, we've also developed a new mobile experience that users will be seamlessly migrated to, allowing Charles Stanley to retire their legacy infrastructure without disruption to users.

Even if your long-time plan is to launch a new app, you can still find ways to add incremental value to your user experience whether that is embedding identity verification, or rolling out digital payment flows. By delivering secure, customer-facing layers first, firms can create tangible value quickly without full-scale disruption.

Trust must be built with seamless, thoughtful experiences

In a sector where trust is critical, poor digital experiences can quietly erode confidence and loyalty.

80% of users delete apps after usability issues

90% of companies lose potential customers during the digital onboarding process

Trust begins at the first tap. Whether it's onboarding a new customer, applying for a product, or completing a payment; every digital interaction is an opportunity to build (or lose) confidence.

Having worked with a range of financial services brands, we have found the most effective way to reduce drop-off and boost retention is by designing experiences that are fast, intuitive and transparent.

For example, Chetwood Financial saw a 99% customer satisfaction rate for onboarding after we designed and delivered a mobile journey that keeps friction to a minimum but still meets regulatory requirements. When users understand what’s happening, and they can move through steps with ease to get value more swiftly — trust follows.

And it doesn’t stop at onboarding. Features like real-time updates, in-app support, plus personalised insights and content all contribute to making customers feel informed, in control and valued.

Regulation and compliance are only getting tougher

From GDPR to PSD2 to the EU’s new DORA regulation, the compliance landscape can put a strain on internal resources for many organisations.

Rather than slowing down innovation, building regulatory readiness into every stage of mobile product development can help you keep ahead of evolving regulations. That includes consent frameworks, data controls, and audit-ready documentation that allows you to stay compliant without compromising on user experience or speed.

Turning pressure into progress

Whether it’s helping neobanks scale faster, enabling traditional banks to modernise customer journeys, or supporting FinTechs with high-performance mobile apps; our mobile experts help businesses build products that solve real challenges, strengthen customer relationships, and unlock new value.

If you’re heading to Money20/20 and want to talk about mobile innovation, customer experience, or smarter ways to scale, reach out to schedule an appointment, we’d love to hear from you.

Share

What could mobile innovation look like for you?

Get in touch for a discovery call